How Can I Apply The BCG Matrix

-

Arushi Kapoor

- 16 Sep 2020

-

Arushi Kapoor

- 16 Sep 2020

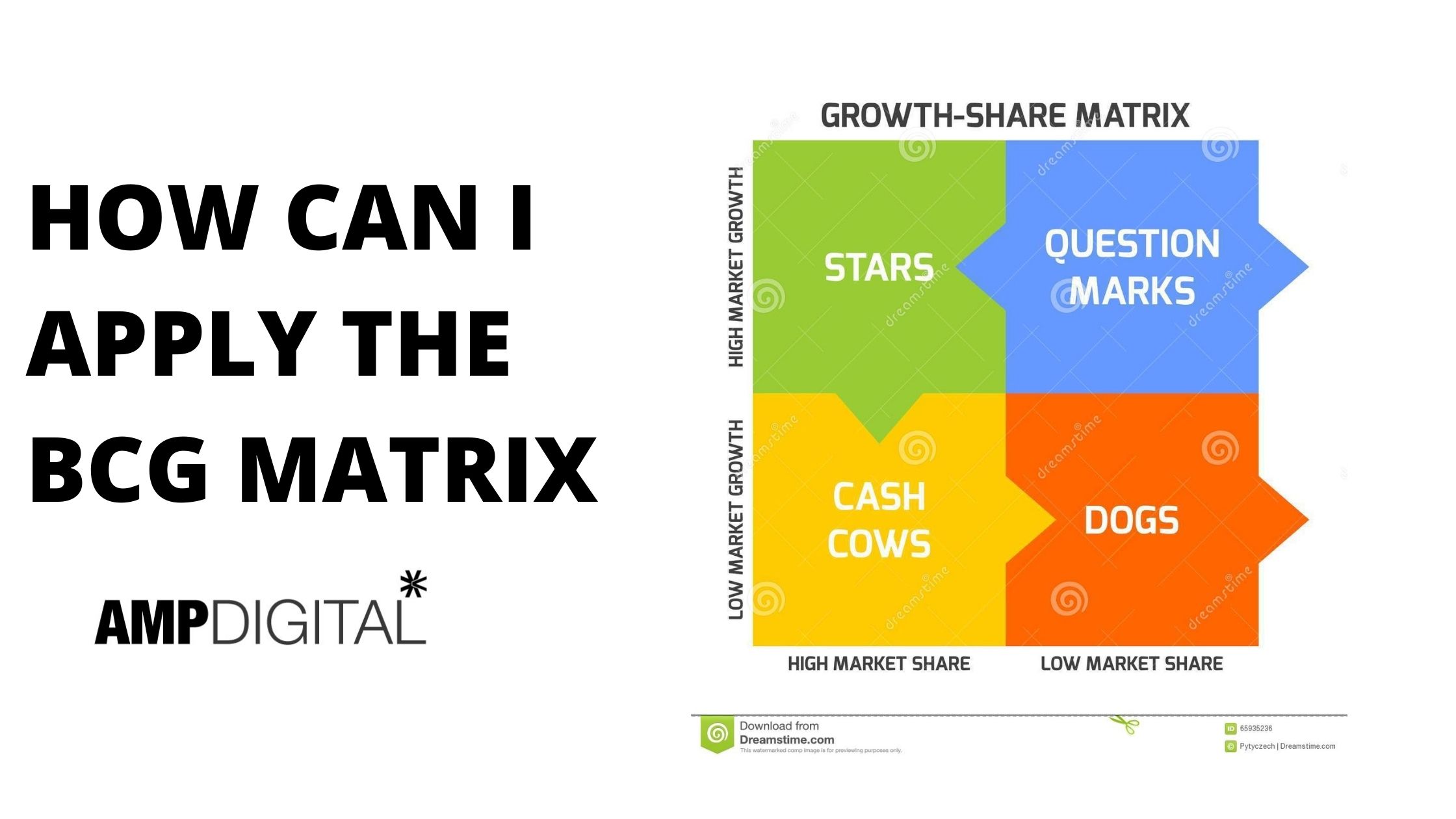

The BCG Model is today used all over the world for strategic decision making to help business analyse growth opportunities in various products offered by a business. It is a graphical representation of a company's product & services to help them analyse which product to keep, which one to sell or invest on.

Let us understand how the matrix works

As discussed earlier BCG Matrix is a graphical representation based on two factors: the market growth rate of the product & the relative market share of the product. So we have relative market share on the X axis & market growth rate on the Y axis.

The products are categorized into four categories namely Stars, Question Marks, Dogs & Cash Cows. Let us see what do they all signify:

Dogs: Talking about dogs, we can see that dogs have low growth rate & low market share. Dogs are all those products that have low share in the market as compared to competitors & they do not generate enough cash as they don’t have growth opportunities. It is usually advised that dogs should be removed from product portfolios as they drain the company's resources.

Cash Cows: Cash Cows are those products that have low growth rate but a large market share as compared to the competitors. Cash Cows are market leaders that generate more cash than what they consume. The revenue from cash cows can be put to stars or question marks. The simple rule is milk your cow & do not kill them. That is, invest in your cows.

Stars: Stars are those products that have a high growth rate & large market share. They generate the maximum cash for any business. They are both cash generators & cash users. Stars consume a lot of a company's resources. If stars can sustain to become market leaders they become cash cows when the growth rate declines.

Question Marks: The products in these categories have a high growth rate but a low market share. As the name suggests it is unknown if it will become a star or a dog. Question Marks require a lot of investment to make it a star product. Companies should closely study if these products are worth investing.

We know that the companies have to utilise their scarce resources in the most optimum manner. This is where this matrix plays a major role. It helps to decide how should be the allotment of various resources in the four categories discussed above & which product to promote & which to drop from the product line.

Let us apply the BCG Matrix to understand it more clearly:

Let us apply the BCG Matrix to the ITC Group that we all can relate to.

Star: The Star products of ITC are paperboard and packaging, Agri business and hotels. These sectors have a high growth rate and ITC has a large market share compared to competitors. ITC is investing immensely in these sectors, these are the greatest revenue generating products for the company.

Cash Cows: The cash cows of ITC are FMCG cigarettes. ITC Ltd offers 80 percent of the cigarettes in India. Cigarettes are a less growing sector with much legal regulations so it is a cash cow for ITC & ITC regularly milks this sector.

Question Marks: Question marks of ITC are FMCG food. This sector has a high growth rate but ITC has a smaller market share in it due to many players in the market. So, ITC is investing in this sector to convert it into a star.

Dogs: The dogs of ITC are ITC InfoTech. ITC Infotech is centered around making esteem through Domain, Data, Digital, Design and Differentiated Delivery for Supply Chain based Industries. This is a dog category for ITC because of its low growth rate & low market share. ITC’s competency is not its Infotech business.

The BCG Matrix has a universal application. It can be applied to small businesses & even in digital marketing. You may have an account on Twitter, Snapchat, Instagram & Youtube. You can arrange all the platforms on BCG & study how you can allocate your resources & time to each of the platforms.

640 comments

In today's fast-paced world, staying informed about the latest developments both locally and globally is more essential than ever. With a plethora of news outlets struggling for attention, it's important to find a trusted source that provides not just news, but insights, and stories that matter to you. This is where <a href=https://www.usatoday.com/>USAtoday.com </a>, a leading online news agency in the USA, stands out. Our dedication to delivering the most current news about the USA and the world makes us a primary resource for readers who seek to stay ahead of the curve. Subscribe for Exclusive Content: By subscribing to <a href=https://www.usatoday.com/>USAtoday.com</a>, you gain access to exclusive content, newsletters, and updates that keep you ahead of the news cycle. <a href=https://www.usatoday.com/>USAtoday.com </a> is not just a news website; it's a dynamic platform that empowers its readers through timely, accurate, and comprehensive reporting. As we navigate through an ever-changing landscape, our mission remains unwavering: to keep you informed, engaged, and connected. Subscribe to us today and become part of a community that values quality journalism and informed citizenship.

16 Jul 2024 17:49 PMIn today's fast-paced world, staying informed about the latest developments both locally and globally is more essential than ever. With a plethora of news outlets struggling for attention, it's important to find a trusted source that provides not just news, but insights, and stories that matter to you. This is where <a href=https://www.usatoday.com/>USAtoday.com </a>, a leading online news agency in the USA, stands out. Our dedication to delivering the most current news about the USA and the world makes us a primary resource for readers who seek to stay ahead of the curve. Subscribe for Exclusive Content: By subscribing to <a href=https://www.usatoday.com/>USAtoday.com</a>, you gain access to exclusive content, newsletters, and updates that keep you ahead of the news cycle. <a href=https://www.usatoday.com/>USAtoday.com </a> is not just a news website; it's a dynamic platform that empowers its readers through timely, accurate, and comprehensive reporting. As we navigate through an ever-changing landscape, our mission remains unwavering: to keep you informed, engaged, and connected. Subscribe to us today and become part of a community that values quality journalism and informed citizenship.

Многие из нас перестали смотреть телевизор , так как интернет источники дают намного больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время основная часть новостных источников подает неправдивую информацию, поэтому приходится перебирать очень тщательно. В поисках хороших СМИ я наткнулся на 2 хороших источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам отбирать только проверенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал полезную новости, которые относится к каждому из нас: http://himeuta.org/member.php?1527344-Svetlbym http://hdplex.com/forum/member.php?u=62719 http://www.ts-gaminggroup.com/member.php?111007-Svetlmuu http://forum.d-dub.com/member.php?837264-Svetlhhg http://adtgamer.com.br/showthread.php?p=483106#post483106

08 Nov 2024 15:47 PMМногие из нас перестали смотреть телевизор , так как интернет источники дают намного больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время основная часть новостных источников подает неправдивую информацию, поэтому приходится перебирать очень тщательно. В поисках хороших СМИ я наткнулся на 2 хороших источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам отбирать только проверенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал полезную новости, которые относится к каждому из нас: http://himeuta.org/member.php?1527344-Svetlbym http://hdplex.com/forum/member.php?u=62719 http://www.ts-gaminggroup.com/member.php?111007-Svetlmuu http://forum.d-dub.com/member.php?837264-Svetlhhg http://adtgamer.com.br/showthread.php?p=483106#post483106

Большинство из нас перестали смотреть TV, так как интернет источники дают намного больше честной информации и можно выбирать кого читать, а кого нет. Но в последнее время большая часть СМИ подает неправдивую информацию, поэтому приходится искать очень тщательно. В поисках хороших СМИ я наткнулся на 2 качественных источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам отбирать только проверенные новостные источники СМИ чтоб не остаться обманутым. Кстати, совсем недавно прочитал полезную новости, которые касаются каждого из нас : http://hubert.cornet1.free.fr/member.php?3276-Svetlbng http://wrestlinguniverse.de/viewtopic.php?f=14&t=9370 http://www.adtgamer.com.br/showthread.php?p=481048#post481048 http://forum.americandream.de/memberlist.php?mode=viewprofile&u=5939 http://www.adtgamer.com.br/showthread.php?p=482333#post482333

09 Nov 2024 09:44 AMБольшинство из нас перестали смотреть TV, так как интернет источники дают намного больше честной информации и можно выбирать кого читать, а кого нет. Но в последнее время большая часть СМИ подает неправдивую информацию, поэтому приходится искать очень тщательно. В поисках хороших СМИ я наткнулся на 2 качественных источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам отбирать только проверенные новостные источники СМИ чтоб не остаться обманутым. Кстати, совсем недавно прочитал полезную новости, которые касаются каждого из нас : http://hubert.cornet1.free.fr/member.php?3276-Svetlbng http://wrestlinguniverse.de/viewtopic.php?f=14&t=9370 http://www.adtgamer.com.br/showthread.php?p=481048#post481048 http://forum.americandream.de/memberlist.php?mode=viewprofile&u=5939 http://www.adtgamer.com.br/showthread.php?p=482333#post482333

Большинство из нас перестали смотреть телевизор , так как интернет источники дают намного больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время большая часть СМИ подает неправдивую информацию, поэтому приходится искать очень аккуратно . В поисках хороших СМИ я наткнулся на 2 хороших источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам выбирать только качестенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал Важные новости, которые относится к каждому из нас: http://forum.d-dub.com/member.php?836239-Svetlonm http://himeuta.org/member.php?1527230-Svetlolm http://www.adtgamer.com.br/showthread.php?p=482304#post482304 http://forum.d-dub.com/member.php?836295-Svetldik http://ternovka4school.org.ua/user/Svetlvci/

09 Nov 2024 14:07 PMБольшинство из нас перестали смотреть телевизор , так как интернет источники дают намного больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время большая часть СМИ подает неправдивую информацию, поэтому приходится искать очень аккуратно . В поисках хороших СМИ я наткнулся на 2 хороших источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам выбирать только качестенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал Важные новости, которые относится к каждому из нас: http://forum.d-dub.com/member.php?836239-Svetlonm http://himeuta.org/member.php?1527230-Svetlolm http://www.adtgamer.com.br/showthread.php?p=482304#post482304 http://forum.d-dub.com/member.php?836295-Svetldik http://ternovka4school.org.ua/user/Svetlvci/

Большинство из нас перестали смотреть TV, так как интернет источники дают намного больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время основная часть новостных источников подает искаженную информацию, поэтому приходится перебирать очень аккуратно . В поисках хороших СМИ я наткнулся на 2 качественных источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам отбирать только качестенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал Важные новости, которые относится к каждому из нас: http://www.smokinstangs.com/member.php/277019-Svetlfhw http://www.jeepin.com/forum/member.php?u=115080 http://www.jeepin.com/forum/member.php?u=115204 http://www.ra-journal.ru/board/member.php?258196-Svetlinx http://www.smokinstangs.com/member.php/275377-Svetlhrg

09 Nov 2024 21:01 PMБольшинство из нас перестали смотреть TV, так как интернет источники дают намного больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время основная часть новостных источников подает искаженную информацию, поэтому приходится перебирать очень аккуратно . В поисках хороших СМИ я наткнулся на 2 качественных источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам отбирать только качестенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал Важные новости, которые относится к каждому из нас: http://www.smokinstangs.com/member.php/277019-Svetlfhw http://www.jeepin.com/forum/member.php?u=115080 http://www.jeepin.com/forum/member.php?u=115204 http://www.ra-journal.ru/board/member.php?258196-Svetlinx http://www.smokinstangs.com/member.php/275377-Svetlhrg

Многие из нас перестали смотреть TV, так как интернет источники дают больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время основная часть новостных источников подает неправдивую информацию, поэтому приходится искать очень аккуратно . В поисках хороших СМИ я наткнулся на 2 качественных источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам отбирать только проверенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал полезную новости, которые относится к каждому из нас: http://youhotel.ru/forum/viewtopic.php?f=15&t=137857 http://www.algazalischool.com/vb/showthread.php?136686-%C7%ED%EE-2024&p=724291#post724291 http://159.203.175.234/forum/member.php?u=1259 http://www.forumdipace.org/profile.php?mode=viewprofile&u=153674 http://forum.d-dub.com/member.php?834459-Svetlzdz

10 Nov 2024 10:23 AMМногие из нас перестали смотреть TV, так как интернет источники дают больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время основная часть новостных источников подает неправдивую информацию, поэтому приходится искать очень аккуратно . В поисках хороших СМИ я наткнулся на 2 качественных источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам отбирать только проверенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал полезную новости, которые относится к каждому из нас: http://youhotel.ru/forum/viewtopic.php?f=15&t=137857 http://www.algazalischool.com/vb/showthread.php?136686-%C7%ED%EE-2024&p=724291#post724291 http://159.203.175.234/forum/member.php?u=1259 http://www.forumdipace.org/profile.php?mode=viewprofile&u=153674 http://forum.d-dub.com/member.php?834459-Svetlzdz

Большинство из нас перестали смотреть телевизор , так как интернет источники дают намного больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время основная часть СМИ подает неправдивую информацию, поэтому приходится перебирать очень аккуратно . В поисках хороших СМИ я наткнулся на 2 качественных источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам отбирать только проверенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал Важные новости, которые относится к каждому из нас: http://www.adtgamer.com.br/showthread.php?p=481092#post481092 http://www.smokinstangs.com/member.php/275177-Svetlvml http://forum.ll2.ru/member.php?693138-Svetltle http://hdplex.com/forum/member.php?u=62406 http://www.glaschat.ru/glas-f/member.php?317578-Svetlaml

10 Nov 2024 20:23 PMБольшинство из нас перестали смотреть телевизор , так как интернет источники дают намного больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время основная часть СМИ подает неправдивую информацию, поэтому приходится перебирать очень аккуратно . В поисках хороших СМИ я наткнулся на 2 качественных источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам отбирать только проверенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал Важные новости, которые относится к каждому из нас: http://www.adtgamer.com.br/showthread.php?p=481092#post481092 http://www.smokinstangs.com/member.php/275177-Svetlvml http://forum.ll2.ru/member.php?693138-Svetltle http://hdplex.com/forum/member.php?u=62406 http://www.glaschat.ru/glas-f/member.php?317578-Svetlaml

Большинство из нас перестали смотреть TV, так как интернет источники дают больше честной информации и можно выбирать кого читать, а кого нет. Но в последнее время большая часть СМИ подает искаженную информацию, поэтому приходится перебирать очень тщательно. В поисках хороших СМИ я наткнулся на 2 качественных источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам отбирать только качестенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал полезную новости, которые относится к каждому из нас: http://www.6x6world.com/forums/member.php?u=41328 http://himeuta.org/member.php?1527667-Svetlsqw http://www.smokinstangs.com/member.php/275570-Svetlihs http://www.forumdipace.org/profile.php?mode=viewprofile&u=152452 http://himeuta.org/member.php?1526685-Svetlshu

11 Nov 2024 11:59 AMБольшинство из нас перестали смотреть TV, так как интернет источники дают больше честной информации и можно выбирать кого читать, а кого нет. Но в последнее время большая часть СМИ подает искаженную информацию, поэтому приходится перебирать очень тщательно. В поисках хороших СМИ я наткнулся на 2 качественных источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам отбирать только качестенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал полезную новости, которые относится к каждому из нас: http://www.6x6world.com/forums/member.php?u=41328 http://himeuta.org/member.php?1527667-Svetlsqw http://www.smokinstangs.com/member.php/275570-Svetlihs http://www.forumdipace.org/profile.php?mode=viewprofile&u=152452 http://himeuta.org/member.php?1526685-Svetlshu

Большинство из нас перестали смотреть телевизор , так как интернет источники дают больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время основная часть СМИ подает неправдивую информацию, поэтому приходится перебирать очень аккуратно . В поисках хороших СМИ я наткнулся на 2 хороших источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам выбирать только качестенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал полезную новости, которые касаются каждого из нас : http://www.ts-gaminggroup.com/showthread.php?180332-%D0%A0%E2%80%94%D0%A0%C2%B0%D0%A1%D0%82%D0%A0%D1%97%D0%A0%C2%BB%D0%A0%C2%B0%D0%A1%E2%80%9A%D0%A0%C2%B0-%D0%A0%D0%88%D0%A1%E2%80%A1%D0%A0%D1%91%D0%A1%E2%80%9A%D0%A0%C2%B5%D0%A0%C2%BB%D0%A0%C2%B5%D0%A0%E2%84%96-%D0%A0%E2%80%99-%D0%A0%D0%88%D0%A0%D1%94%D0%A1%D0%82%D0%A0%C2%B0%D0%A0%D1%91%D0%A0%D0%85%D0%A0%C2%B5-2024&p=1085325#post1085325 http://www.smokinstangs.com/member.php/275932-Svetlksc http://www.c-strike.fakaheda.eu/forum/viewthread.php?thread_id=60400 http://www.adtgamer.com.br/showthread.php?p=482627#post482627 http://www.servinord.com/phpBB2/profile.php?mode=viewprofile&u=266051

11 Nov 2024 16:30 PMБольшинство из нас перестали смотреть телевизор , так как интернет источники дают больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время основная часть СМИ подает неправдивую информацию, поэтому приходится перебирать очень аккуратно . В поисках хороших СМИ я наткнулся на 2 хороших источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам выбирать только качестенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал полезную новости, которые касаются каждого из нас : http://www.ts-gaminggroup.com/showthread.php?180332-%D0%A0%E2%80%94%D0%A0%C2%B0%D0%A1%D0%82%D0%A0%D1%97%D0%A0%C2%BB%D0%A0%C2%B0%D0%A1%E2%80%9A%D0%A0%C2%B0-%D0%A0%D0%88%D0%A1%E2%80%A1%D0%A0%D1%91%D0%A1%E2%80%9A%D0%A0%C2%B5%D0%A0%C2%BB%D0%A0%C2%B5%D0%A0%E2%84%96-%D0%A0%E2%80%99-%D0%A0%D0%88%D0%A0%D1%94%D0%A1%D0%82%D0%A0%C2%B0%D0%A0%D1%91%D0%A0%D0%85%D0%A0%C2%B5-2024&p=1085325#post1085325 http://www.smokinstangs.com/member.php/275932-Svetlksc http://www.c-strike.fakaheda.eu/forum/viewthread.php?thread_id=60400 http://www.adtgamer.com.br/showthread.php?p=482627#post482627 http://www.servinord.com/phpBB2/profile.php?mode=viewprofile&u=266051

Большинство из нас перестали смотреть телевизор , так как интернет источники дают намного больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время основная часть новостных источников подает искаженную информацию, поэтому приходится перебирать очень тщательно. В поисках хороших СМИ я наткнулся на 2 качественных источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам выбирать только проверенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал Важные новости, которые относится к каждому из нас: http://ocsuburbs.com/viewtopic.php?t=80860 http://www.jeepin.com/forum/member.php?u=115786 http://www.adtgamer.com.br/showthread.php?p=484062#post484062 http://www.smokinstangs.com/member.php/275237-Svetlgzv http://www.forumdipace.org/profile.php?mode=viewprofile&u=153713

11 Nov 2024 22:55 PMБольшинство из нас перестали смотреть телевизор , так как интернет источники дают намного больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время основная часть новостных источников подает искаженную информацию, поэтому приходится перебирать очень тщательно. В поисках хороших СМИ я наткнулся на 2 качественных источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам выбирать только проверенные новостные источники чтоб не остаться обманутым. Кстати, совсем недавно прочитал Важные новости, которые относится к каждому из нас: http://ocsuburbs.com/viewtopic.php?t=80860 http://www.jeepin.com/forum/member.php?u=115786 http://www.adtgamer.com.br/showthread.php?p=484062#post484062 http://www.smokinstangs.com/member.php/275237-Svetlgzv http://www.forumdipace.org/profile.php?mode=viewprofile&u=153713

Большинство из нас перестали смотреть TV, так как интернет источники дают намного больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время большая часть новостных источников подает неправдивую информацию, поэтому приходится искать очень аккуратно . В поисках хороших СМИ я наткнулся на 2 хороших источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам выбирать только проверенные новостные источники СМИ чтоб не остаться обманутым. Кстати, совсем недавно прочитал полезную новости, которые касаются каждого из нас : http://www.glaschat.ru/glas-f/member.php?317011-Svetllqq http://adtgamer.com.br/showthread.php?p=483054#post483054 http://forum.antiq.in/member.php?u=24975 http://forum.d-dub.com/member.php?834429-Svetlnic http://www.spookyrealm.com/members/adizzyswifta3956.html

12 Nov 2024 08:46 AMБольшинство из нас перестали смотреть TV, так как интернет источники дают намного больше правдивой информации и можно выбирать кого читать, а кого нет. Но в последнее время большая часть новостных источников подает неправдивую информацию, поэтому приходится искать очень аккуратно . В поисках хороших СМИ я наткнулся на 2 хороших источника: ukr-life.com.ua и sylnaukraina.com.ua. Рекомендую и Вам выбирать только проверенные новостные источники СМИ чтоб не остаться обманутым. Кстати, совсем недавно прочитал полезную новости, которые касаются каждого из нас : http://www.glaschat.ru/glas-f/member.php?317011-Svetllqq http://adtgamer.com.br/showthread.php?p=483054#post483054 http://forum.antiq.in/member.php?u=24975 http://forum.d-dub.com/member.php?834429-Svetlnic http://www.spookyrealm.com/members/adizzyswifta3956.html

Do you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://www.oople.com/forums/member.php?u=236162 http://bbs.cheaa.com/home.php?mod=space&uid=3097317 http://adtgamer.com.br/showthread.php?p=486250#post486250 http://www.victoriarabien.ugu.pl/forum/viewtopic.php?f=4&t=91535 http://www.spearboard.com/member.php?u=805477

12 Nov 2024 16:55 PMDo you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://www.oople.com/forums/member.php?u=236162 http://bbs.cheaa.com/home.php?mod=space&uid=3097317 http://adtgamer.com.br/showthread.php?p=486250#post486250 http://www.victoriarabien.ugu.pl/forum/viewtopic.php?f=4&t=91535 http://www.spearboard.com/member.php?u=805477

Do you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://forum.d-dub.com/member.php?840064-Serglem http://hdplex.com/forum/member.php?u=80114 http://www.depaddock.eu/forum/member.php?u=5400 http://www.c-strike.fakaheda.eu/forum/viewthread.php?thread_id=59011 http://forum.mlotoolkit.com/viewtopic.php?t=2437

12 Nov 2024 21:48 PMDo you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://forum.d-dub.com/member.php?840064-Serglem http://hdplex.com/forum/member.php?u=80114 http://www.depaddock.eu/forum/member.php?u=5400 http://www.c-strike.fakaheda.eu/forum/viewthread.php?thread_id=59011 http://forum.mlotoolkit.com/viewtopic.php?t=2437

Do you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://services-sector.ru/clubpointeresam/memberlist.php?mode=viewprofile&u=47844 http://www.jeepin.com/forum/member.php?u=126152 http://www.oople.com/forums/member.php?u=236381 http://www.adtgamer.com.br/showthread.php?p=484660#post484660 http://www.hdplex.com/forum/member.php?u=36519

13 Nov 2024 10:12 AMDo you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://services-sector.ru/clubpointeresam/memberlist.php?mode=viewprofile&u=47844 http://www.jeepin.com/forum/member.php?u=126152 http://www.oople.com/forums/member.php?u=236381 http://www.adtgamer.com.br/showthread.php?p=484660#post484660 http://www.hdplex.com/forum/member.php?u=36519

Do you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://psyru.com/forum.php?mod=viewthread&tid=430664&extra= http://www.oople.com/forums/member.php?u=237491 http://forum.d-dub.com/member.php?838997-Sergukr http://himeuta.org/member.php?1530723-Serglhy http://www.ra-journal.ru/board/member.php?259261-Sergpen

13 Nov 2024 15:17 PMDo you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://psyru.com/forum.php?mod=viewthread&tid=430664&extra= http://www.oople.com/forums/member.php?u=237491 http://forum.d-dub.com/member.php?838997-Sergukr http://himeuta.org/member.php?1530723-Serglhy http://www.ra-journal.ru/board/member.php?259261-Sergpen

Do you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://wiseturtle.razornetwork.com/viewtopic.php?t=135178 http://www.forumdipace.org/profile.php?mode=viewprofile&u=181962 http://himeuta.org/member.php?1530729-Sergnrd http://www.spookyrealm.com/members/babobytivanovy3177.html http://forum.survival-readiness.com/viewtopic.php?t=245032

13 Nov 2024 20:40 PMDo you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://wiseturtle.razornetwork.com/viewtopic.php?t=135178 http://www.forumdipace.org/profile.php?mode=viewprofile&u=181962 http://himeuta.org/member.php?1530729-Sergnrd http://www.spookyrealm.com/members/babobytivanovy3177.html http://forum.survival-readiness.com/viewtopic.php?t=245032

Do you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://www.ts-gaminggroup.com/showthread.php?178941-Halloween-2024&p=1075364#post1075364 http://www.adtgamer.com.br/showthread.php?p=481494#post481494 http://hubert.cornet1.free.fr/member.php?3305-Sergxbn http://www.adtgamer.com.br/showthread.php?p=483709#post483709 http://www.adtgamer.com.br/showthread.php?p=485935#post485935

14 Nov 2024 13:34 PMDo you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://www.ts-gaminggroup.com/showthread.php?178941-Halloween-2024&p=1075364#post1075364 http://www.adtgamer.com.br/showthread.php?p=481494#post481494 http://hubert.cornet1.free.fr/member.php?3305-Sergxbn http://www.adtgamer.com.br/showthread.php?p=483709#post483709 http://www.adtgamer.com.br/showthread.php?p=485935#post485935

Do you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://forum.survival-readiness.com/viewtopic.php?t=245289 http://bjoernvold.com/forum/viewtopic.php?f=20&t=20108 http://forum.d-dub.com/member.php?839657-Sergcyx http://forum.gokickoff.com/index.php?topic=92291.new#new http://bocauvietnam.com/member.php?1251820-Sergpxq

15 Nov 2024 10:07 AMDo you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://forum.survival-readiness.com/viewtopic.php?t=245289 http://bjoernvold.com/forum/viewtopic.php?f=20&t=20108 http://forum.d-dub.com/member.php?839657-Sergcyx http://forum.gokickoff.com/index.php?topic=92291.new#new http://bocauvietnam.com/member.php?1251820-Sergpxq

Do you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://www.smokinstangs.com/member.php/278509-Sergcee http://www.adtgamer.com.br/showthread.php?p=485252#post485252 http://acceptance.whips-bge.com/forums/viewtopic.php?f=11&t=267159 http://www.smokinstangs.com/member.php/278543-Sergkxe http://forum.gokickoff.com/index.php?topic=92243.new#new

15 Nov 2024 15:15 PMDo you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://www.smokinstangs.com/member.php/278509-Sergcee http://www.adtgamer.com.br/showthread.php?p=485252#post485252 http://acceptance.whips-bge.com/forums/viewtopic.php?f=11&t=267159 http://www.smokinstangs.com/member.php/278543-Sergkxe http://forum.gokickoff.com/index.php?topic=92243.new#new

Do you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://www.smokinstangs.com/member.php/278289-Sergkdj http://www.jeepin.com/forum/member.php?u=129656 http://www.oople.com/forums/member.php?u=236589 http://www.servinord.com/phpBB2/profile.php?mode=viewprofile&u=266961 http://adtgamer.com.br/showthread.php?p=486278#post486278

15 Nov 2024 21:43 PMDo you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://www.smokinstangs.com/member.php/278289-Sergkdj http://www.jeepin.com/forum/member.php?u=129656 http://www.oople.com/forums/member.php?u=236589 http://www.servinord.com/phpBB2/profile.php?mode=viewprofile&u=266961 http://adtgamer.com.br/showthread.php?p=486278#post486278

Советую Вам настоящую пасеку, на которой покупаю большой ассортимент продуктов для иммунитета как для себя таки для своих знакомых. Пчеловоды оформляют всю продукцию пчеловодства на проффесионально, советы как принимать по важным вопросам дают. Очень много нужных статей на интернет странице, Вот несколько из них: http://adtgamer.com.br/showthread.php?p=487789#post487789 http://forum.d-dub.com/member.php?839277-Svetlanakml http://www.glaschat.ru/glas-f/member.php?475060-Veronatnz http://psyru.com/forum.php?mod=viewthread&tid=455170&extra= http://www.x443001.secure.ne.jp/test/profile.php?mode=viewprofile&u=6310 Одним словом они молодцы и я их рекомендую. Вот их портал где я заказывал пчелопродукты.

16 Nov 2024 09:29 AMСоветую Вам настоящую пасеку, на которой покупаю большой ассортимент продуктов для иммунитета как для себя таки для своих знакомых. Пчеловоды оформляют всю продукцию пчеловодства на проффесионально, советы как принимать по важным вопросам дают. Очень много нужных статей на интернет странице, Вот несколько из них: http://adtgamer.com.br/showthread.php?p=487789#post487789 http://forum.d-dub.com/member.php?839277-Svetlanakml http://www.glaschat.ru/glas-f/member.php?475060-Veronatnz http://psyru.com/forum.php?mod=viewthread&tid=455170&extra= http://www.x443001.secure.ne.jp/test/profile.php?mode=viewprofile&u=6310 Одним словом они молодцы и я их рекомендую. Вот их портал где я заказывал пчелопродукты.

Do you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://www.adtgamer.com.br/showthread.php?p=482918#post482918 http://forum.gokickoff.com/index.php?topic=88831.new#new http://www.victoriarabien.ugu.pl/forum/viewtopic.php?f=2&t=91313 http://www.scoreit.org/p/sergzmc http://518809.com/viewthread.php?tid=95446&pid=111830&page=1&extra=page%3D1#pid111830

16 Nov 2024 09:29 AMDo you know what holiday it is today? We are used to the fact that we know only religious and public holidays and celebrate only them. I found out about this only yesterday after visiting the our site. It turns out that every day there are from 2 to 10 different holidays that surround us and make our lives happier. Here is one of the holidays that will be today: http://www.adtgamer.com.br/showthread.php?p=482918#post482918 http://forum.gokickoff.com/index.php?topic=88831.new#new http://www.victoriarabien.ugu.pl/forum/viewtopic.php?f=2&t=91313 http://www.scoreit.org/p/sergzmc http://518809.com/viewthread.php?tid=95446&pid=111830&page=1&extra=page%3D1#pid111830

Советую Вам настоящую пасеку, на которой заказываю большой ассортимент пчелопродукции как для себя таки для своих друзей. Пчеловоды делают всю продукцию пчеловодства на отлично, консультации по важным вопросам дают. Очень много качественных статей на портале, Вот несколько из них: http://georgiantheatre.ge/user/Svetlanashf/ http://www.spookyrealm.com/members/bgreorasshtolzey5788.html http://forum.ll2.ru/member.php?694813-Svetlanatgo http://himeuta.org/member.php?1530417-Svetlanafxe http://www.adtgamer.com.br/showthread.php?p=485262#post485262 Одним словом они молодцы и я их советую. Вот их портал где я оформлял продукты для иммунитета.

16 Nov 2024 18:24 PMСоветую Вам настоящую пасеку, на которой заказываю большой ассортимент пчелопродукции как для себя таки для своих друзей. Пчеловоды делают всю продукцию пчеловодства на отлично, консультации по важным вопросам дают. Очень много качественных статей на портале, Вот несколько из них: http://georgiantheatre.ge/user/Svetlanashf/ http://www.spookyrealm.com/members/bgreorasshtolzey5788.html http://forum.ll2.ru/member.php?694813-Svetlanatgo http://himeuta.org/member.php?1530417-Svetlanafxe http://www.adtgamer.com.br/showthread.php?p=485262#post485262 Одним словом они молодцы и я их советую. Вот их портал где я оформлял продукты для иммунитета.

Каждый из нас любит почитать СМИ или посмотреть Youtube, что узнать что происходит в мире и Украине. Но очень важно чтоб источник новостей был честный и Вы не получали лживую информацию. Я нашел очень хороший источник новостей и советую его Вам - ukr-life.com.ua Последнее время смотрю новости только здесь. Так же вот несколько из свежих новостей, которые просто сбивает с ног: http://www.dendymaster.ru/forum/showthread.php?p=39909&posted=1#post39909 http://vagsg.com/forums/member.php?u=102886 http://www.adtgamer.com.br/showthread.php?p=489477#post489477 http://www.adtgamer.com.br/showthread.php?p=492224#post492224 http://www.adtgamer.com.br/showthread.php?p=490893#post490893

16 Nov 2024 18:25 PMКаждый из нас любит почитать СМИ или посмотреть Youtube, что узнать что происходит в мире и Украине. Но очень важно чтоб источник новостей был честный и Вы не получали лживую информацию. Я нашел очень хороший источник новостей и советую его Вам - ukr-life.com.ua Последнее время смотрю новости только здесь. Так же вот несколько из свежих новостей, которые просто сбивает с ног: http://www.dendymaster.ru/forum/showthread.php?p=39909&posted=1#post39909 http://vagsg.com/forums/member.php?u=102886 http://www.adtgamer.com.br/showthread.php?p=489477#post489477 http://www.adtgamer.com.br/showthread.php?p=492224#post492224 http://www.adtgamer.com.br/showthread.php?p=490893#post490893

Каждый из нас любит почитать новости или посмотреть Ютуб, что узнать что творится в мире и Украине. Но очень важно чтоб источник новостей был правдивый и Вы не получали искаженную информацию. Я нашел очень полезный источник новостей и советую его Вам - ukr-life.com.ua Последнее время читаю новости только здесь. Так же вот несколько из свежих статей, которые просто взрывает мозг: http://adtgamer.com.br/showthread.php?p=493808#post493808 http://www.ts-gaminggroup.com/member.php?485686-Igorrlu http://www.spookyrealm.com/members/ophiattso613.html http://web.mdu.edu.ua/index.php?subaction=userinfo&user=Igorjqs http://forum.d-dub.com/member.php?837258-Igorizo

16 Nov 2024 22:34 PMКаждый из нас любит почитать новости или посмотреть Ютуб, что узнать что творится в мире и Украине. Но очень важно чтоб источник новостей был правдивый и Вы не получали искаженную информацию. Я нашел очень полезный источник новостей и советую его Вам - ukr-life.com.ua Последнее время читаю новости только здесь. Так же вот несколько из свежих статей, которые просто взрывает мозг: http://adtgamer.com.br/showthread.php?p=493808#post493808 http://www.ts-gaminggroup.com/member.php?485686-Igorrlu http://www.spookyrealm.com/members/ophiattso613.html http://web.mdu.edu.ua/index.php?subaction=userinfo&user=Igorjqs http://forum.d-dub.com/member.php?837258-Igorizo

Каждый из нас любит почитать СМИ или посмотреть Youtube, что узнать что творится в мире и Украине. Но очень важно чтоб источник новостей был честный и Вы не получали вредную информацию. Я нашел очень хороший источник новостей и рекомендую его Вам - ukr-life.com.ua Последнее время читаю новости только здесь. Так же вот несколько из актуальных новостей, которые просто взрывает мозг: http://www.spearboard.com/member.php?u=802968 http://www.adtgamer.com.br/showthread.php?p=493995#post493995 http://forum.d-dub.com/member.php?837894-Igorajk http://forum.d-dub.com/member.php?836417-Igorpct http://ekaterinovka.sarat.ru/board/tools.php?event=profile&pname=Igorbri

17 Nov 2024 05:21 AMКаждый из нас любит почитать СМИ или посмотреть Youtube, что узнать что творится в мире и Украине. Но очень важно чтоб источник новостей был честный и Вы не получали вредную информацию. Я нашел очень хороший источник новостей и рекомендую его Вам - ukr-life.com.ua Последнее время читаю новости только здесь. Так же вот несколько из актуальных новостей, которые просто взрывает мозг: http://www.spearboard.com/member.php?u=802968 http://www.adtgamer.com.br/showthread.php?p=493995#post493995 http://forum.d-dub.com/member.php?837894-Igorajk http://forum.d-dub.com/member.php?836417-Igorpct http://ekaterinovka.sarat.ru/board/tools.php?event=profile&pname=Igorbri

Каждый из нас любит почитать новости или посмотреть Ютуб, что узнать что делается в мире и Украине. Но очень важно чтоб источник новостей был правдивый и Вы не получали искаженную информацию. Я нашел очень полезный источник новостей и рекомендую его Вам - ukr-life.com.ua Последнее время читаю новости только здесь. Так же вот несколько из актуальных статей, которые просто взрывает мозг: http://adtgamer.com.br/showthread.php?p=493822#post493822 http://islamavenir.free.fr/member.php?878-Igorpqk http://forums.panzergrenadiers.com/member.php?39885-Igorrey http://swissairways-va.com/phpBB3/viewtopic.php?t=623857 http://forum.ll2.ru/member.php?693612-Igornom

17 Nov 2024 09:44 AMКаждый из нас любит почитать новости или посмотреть Ютуб, что узнать что делается в мире и Украине. Но очень важно чтоб источник новостей был правдивый и Вы не получали искаженную информацию. Я нашел очень полезный источник новостей и рекомендую его Вам - ukr-life.com.ua Последнее время читаю новости только здесь. Так же вот несколько из актуальных статей, которые просто взрывает мозг: http://adtgamer.com.br/showthread.php?p=493822#post493822 http://islamavenir.free.fr/member.php?878-Igorpqk http://forums.panzergrenadiers.com/member.php?39885-Igorrey http://swissairways-va.com/phpBB3/viewtopic.php?t=623857 http://forum.ll2.ru/member.php?693612-Igornom

Советую Вам настоящую пасеку, на которой заказываю большой ассортимент продукции как для себя таки для своих друзей. Пчеловоды высылают всю пчелопродукцию на проффесионально, советы как пользоваться по важным вопросам дают. Очень много полезных статей на портале, Вот несколько из них: http://www.hdplex.com/forum/member.php?u=37171 http://forums.outdoorreview.com/member.php?293449-Svetlanajzn http://forum.politm.ro/viewtopic.php?f=19&t=9583 http://www.adtgamer.com.br/showthread.php?p=489356#post489356 http://spearboard.com/member.php?u=1278889 Одним словом они молодцы и я их советую. Вот их блог где я покупал продукты для иммунитета.

17 Nov 2024 09:44 AMСоветую Вам настоящую пасеку, на которой заказываю большой ассортимент продукции как для себя таки для своих друзей. Пчеловоды высылают всю пчелопродукцию на проффесионально, советы как пользоваться по важным вопросам дают. Очень много полезных статей на портале, Вот несколько из них: http://www.hdplex.com/forum/member.php?u=37171 http://forums.outdoorreview.com/member.php?293449-Svetlanajzn http://forum.politm.ro/viewtopic.php?f=19&t=9583 http://www.adtgamer.com.br/showthread.php?p=489356#post489356 http://spearboard.com/member.php?u=1278889 Одним словом они молодцы и я их советую. Вот их блог где я покупал продукты для иммунитета.

Каждый из нас любит почитать новости или посмотреть Ютубчик, что узнать что творится в мире и Украине. Но очень важно чтоб источник новостей был правдивый и Вы не получали лживую информацию. Я нашел очень полезный источник новостей и советую его Вам - ukr-life.com.ua Последнее время изучаю новости только здесь. Так же вот несколько из свежих статей, которые просто сбивает с ног: http://www.spearboard.com/member.php?u=803279 http://www.adtgamer.com.br/showthread.php?p=490029#post490029 http://www.forumeteo-emr.it/member.php?u=16234 http://www.c-strike.fakaheda.eu/forum/viewthread.php?thread_id=63737 http://forum.d-dub.com/member.php?836870-Igoreil

17 Nov 2024 16:03 PMКаждый из нас любит почитать новости или посмотреть Ютубчик, что узнать что творится в мире и Украине. Но очень важно чтоб источник новостей был правдивый и Вы не получали лживую информацию. Я нашел очень полезный источник новостей и советую его Вам - ukr-life.com.ua Последнее время изучаю новости только здесь. Так же вот несколько из свежих статей, которые просто сбивает с ног: http://www.spearboard.com/member.php?u=803279 http://www.adtgamer.com.br/showthread.php?p=490029#post490029 http://www.forumeteo-emr.it/member.php?u=16234 http://www.c-strike.fakaheda.eu/forum/viewthread.php?thread_id=63737 http://forum.d-dub.com/member.php?836870-Igoreil

Советую Вам качественную пасеку, на которой покупаю большой ассортимент пчелопродукции как для себя таки для своих друзей. Пчеловоды высылают всю пчелопродукцию на пять, советы как пользоваться по важным вопросам дают. Очень много полезных статей на портале, Вот несколько из них: http://oople.com/forums/member.php?u=237196 http://forum.d-dub.com/member.php?840181-Svetlanagmd http://www.adtgamer.com.br/showthread.php?p=485487#post485487 http://forum.cncprovn.com/members/174873-Veronaxhv http://www.c-strike.fakaheda.eu/forum/viewthread.php?thread_id=63705 Одним словом они молодцы и я их советую. Вот их сайт где я покупал иммуностимулирующие продукты.

17 Nov 2024 16:03 PMСоветую Вам качественную пасеку, на которой покупаю большой ассортимент пчелопродукции как для себя таки для своих друзей. Пчеловоды высылают всю пчелопродукцию на пять, советы как пользоваться по важным вопросам дают. Очень много полезных статей на портале, Вот несколько из них: http://oople.com/forums/member.php?u=237196 http://forum.d-dub.com/member.php?840181-Svetlanagmd http://www.adtgamer.com.br/showthread.php?p=485487#post485487 http://forum.cncprovn.com/members/174873-Veronaxhv http://www.c-strike.fakaheda.eu/forum/viewthread.php?thread_id=63705 Одним словом они молодцы и я их советую. Вот их сайт где я покупал иммуностимулирующие продукты.

Каждый из нас любит почитать СМИ или посмотреть Ютубчик, что узнать что происходит в мире и Украине. Но очень важно чтоб источник новостей был честный и Вы не получали искаженную информацию. Я нашел очень хороший источник новостей и советую его Вам - ukr-life.com.ua Последнее время смотрю новости только здесь. Так же вот несколько из последних статей, которые просто взрывает мозг: http://www.adtgamer.com.br/showthread.php?p=490900#post490900 http://www.jeepin.com/forum/member.php?u=175140 http://forum.americandream.de/memberlist.php?mode=viewprofile&u=6745 http://adtgamer.com.br/showthread.php?p=493853#post493853 http://www.smokinstangs.com/member.php/276126-Igorhxn

17 Nov 2024 21:51 PMКаждый из нас любит почитать СМИ или посмотреть Ютубчик, что узнать что происходит в мире и Украине. Но очень важно чтоб источник новостей был честный и Вы не получали искаженную информацию. Я нашел очень хороший источник новостей и советую его Вам - ukr-life.com.ua Последнее время смотрю новости только здесь. Так же вот несколько из последних статей, которые просто взрывает мозг: http://www.adtgamer.com.br/showthread.php?p=490900#post490900 http://www.jeepin.com/forum/member.php?u=175140 http://forum.americandream.de/memberlist.php?mode=viewprofile&u=6745 http://adtgamer.com.br/showthread.php?p=493853#post493853 http://www.smokinstangs.com/member.php/276126-Igorhxn

Советую Вам настоящую пасеку, на которой заказываю большой ассортимент продукции как для себя таки для своих знакомых. Пчеловоды оформляют всю продукцию пчеловодства на отлично, консультации по важным вопросам дают. Очень много полезных статей на портале, Вот несколько из них: http://www.adtgamer.com.br/showthread.php?p=485401#post485401 http://www.oople.com/forums/member.php?u=237358 http://forum.ll2.ru/member.php?695708-Svetlanajrw http://forum.ll2.ru/member.php?743681-Svetlanaoiy http://www.adtgamer.com.br/showthread.php?p=487763#post487763 Одним словом они молодцы и я их советую. Вот их интернет ресурс где я заказывал иммуностимулирующие продукты.

18 Nov 2024 09:37 AMСоветую Вам настоящую пасеку, на которой заказываю большой ассортимент продукции как для себя таки для своих знакомых. Пчеловоды оформляют всю продукцию пчеловодства на отлично, консультации по важным вопросам дают. Очень много полезных статей на портале, Вот несколько из них: http://www.adtgamer.com.br/showthread.php?p=485401#post485401 http://www.oople.com/forums/member.php?u=237358 http://forum.ll2.ru/member.php?695708-Svetlanajrw http://forum.ll2.ru/member.php?743681-Svetlanaoiy http://www.adtgamer.com.br/showthread.php?p=487763#post487763 Одним словом они молодцы и я их советую. Вот их интернет ресурс где я заказывал иммуностимулирующие продукты.

Каждый из нас любит почитать новости или посмотреть Ютубчик, что узнать что творится в мире и Украине. Но очень важно чтоб источник новостей был честный и Вы не получали вредную информацию. Я нашел очень хороший сайт и рекомендую его Вам - ukr-life.com.ua Последнее время изучаю новости только здесь. Так же вот несколько из актуальных новостей, которые просто сбивает с ног: http://www.glaschat.ru/glas-f/member.php?318211-Igorynl http://forum.ll2.ru/member.php?692863-Igorjvc http://www.smokinstangs.com/member.php/276592-Igorooq http://adtgamer.com.br/showthread.php?p=491723#post491723 http://ocsuburbs.com/viewtopic.php?t=84629

18 Nov 2024 09:48 AMКаждый из нас любит почитать новости или посмотреть Ютубчик, что узнать что творится в мире и Украине. Но очень важно чтоб источник новостей был честный и Вы не получали вредную информацию. Я нашел очень хороший сайт и рекомендую его Вам - ukr-life.com.ua Последнее время изучаю новости только здесь. Так же вот несколько из актуальных новостей, которые просто сбивает с ног: http://www.glaschat.ru/glas-f/member.php?318211-Igorynl http://forum.ll2.ru/member.php?692863-Igorjvc http://www.smokinstangs.com/member.php/276592-Igorooq http://adtgamer.com.br/showthread.php?p=491723#post491723 http://ocsuburbs.com/viewtopic.php?t=84629

Советую Вам хорошую пасеку, на которой покупаю большой ассортимент продуктов для иммунитета как для себя таки для своих знакомых. Пчеловоды высылают всю продукцию пчеловодства на отменно, советы как принимать по важным вопросам дают. Очень много нужных статей на сайте, Вот несколько из них: http://www.morehere.org/member.php?u=1467719 http://www.jeepin.com/forum/member.php?u=175198 http://himeuta.org/member.php?1170197-Svetlanawhk http://hogsmeade.pl/profile.php?lookup=54501 http://www.morehere.org/member.php?u=1467721 Одним словом они молодцы и я их рекомендую. Вот их портал где я заказывал продукцию.

18 Nov 2024 18:24 PMСоветую Вам хорошую пасеку, на которой покупаю большой ассортимент продуктов для иммунитета как для себя таки для своих знакомых. Пчеловоды высылают всю продукцию пчеловодства на отменно, советы как принимать по важным вопросам дают. Очень много нужных статей на сайте, Вот несколько из них: http://www.morehere.org/member.php?u=1467719 http://www.jeepin.com/forum/member.php?u=175198 http://himeuta.org/member.php?1170197-Svetlanawhk http://hogsmeade.pl/profile.php?lookup=54501 http://www.morehere.org/member.php?u=1467721 Одним словом они молодцы и я их рекомендую. Вот их портал где я заказывал продукцию.

Каждый из нас любит почитать новости или посмотреть Youtube, что узнать что происходит в мире и Украине. Но очень важно чтоб источник новостей был правдивый и Вы не получали вредную информацию. Я нашел очень полезный источник новостей и советую его Вам - ukr-life.com.ua Последнее время изучаю новости только здесь. Так же вот несколько из свежих новостей, которые просто сбивает с ног: http://oople.com/forums/member.php?u=235317 http://ictonderwijsforum.nl/viewtopic.php?t=397236 http://ictonderwijsforum.nl/viewtopic.php?t=406389 http://www.forumdipace.org/profile.php?mode=viewprofile&u=153781 http://www.adtgamer.com.br/showthread.php?p=496470#post496470

18 Nov 2024 18:37 PMКаждый из нас любит почитать новости или посмотреть Youtube, что узнать что происходит в мире и Украине. Но очень важно чтоб источник новостей был правдивый и Вы не получали вредную информацию. Я нашел очень полезный источник новостей и советую его Вам - ukr-life.com.ua Последнее время изучаю новости только здесь. Так же вот несколько из свежих новостей, которые просто сбивает с ног: http://oople.com/forums/member.php?u=235317 http://ictonderwijsforum.nl/viewtopic.php?t=397236 http://ictonderwijsforum.nl/viewtopic.php?t=406389 http://www.forumdipace.org/profile.php?mode=viewprofile&u=153781 http://www.adtgamer.com.br/showthread.php?p=496470#post496470

Каждый из нас любит почитать новости или посмотреть Youtube, что узнать что делается в мире и Украине. Но очень важно чтоб источник новостей был честный и Вы не получали лживую информацию. Я нашел очень хороший источник новостей и советую его Вам - ukr-life.com.ua Последнее время смотрю новости только здесь. Так же вот несколько из последних статей, которые просто сбивает с ног: http://www.smokinstangs.com/member.php/277530-Igordyu http://www.smokinstangs.com/member.php/276132-Igornep http://adtgamer.com.br/showthread.php?p=489832#post489832 http://45.155.207.140/forum/viewtopic.php?f=7&t=474409 http://www.jeepin.com/forum/member.php?u=115574

19 Nov 2024 09:54 AMКаждый из нас любит почитать новости или посмотреть Youtube, что узнать что делается в мире и Украине. Но очень важно чтоб источник новостей был честный и Вы не получали лживую информацию. Я нашел очень хороший источник новостей и советую его Вам - ukr-life.com.ua Последнее время смотрю новости только здесь. Так же вот несколько из последних статей, которые просто сбивает с ног: http://www.smokinstangs.com/member.php/277530-Igordyu http://www.smokinstangs.com/member.php/276132-Igornep http://adtgamer.com.br/showthread.php?p=489832#post489832 http://45.155.207.140/forum/viewtopic.php?f=7&t=474409 http://www.jeepin.com/forum/member.php?u=115574

Советую Вам хорошую пасеку, на которой заказываю большой ассортимент продуктов пчеловодства как для себя таки для своих друзей. Пчеловоды высылают всю продукцию пчеловодства на отлично, советы как употреблять по важным вопросам дают. Очень много нужных статей на сайте, Вот несколько из них: http://www.adtgamer.com.br/showthread.php?p=486221#post486221 http://www.jeepin.com/forum/member.php?u=175322 http://www.jeepin.com/forum/member.php?u=116760 http://www.ts-gaminggroup.com/showthread.php?181050-%D0%A0%D1%9F%D0%A0%C2%B5%D0%A1%D0%82%D0%A0%D1%96%D0%A0%C2%B0-%D0%A0%D1%9F%D0%A1%E2%80%A1%D0%A0%C2%B5%D0%A0%C2%BB%D0%A1%E2%80%B9&p=1090557#post1090557 http://www.adtgamer.com.br/showthread.php?p=488443#post488443 Одним словом они молодцы и я их советую. Вот их портал где я оформлял иммуностимулирующие продукты.

19 Nov 2024 09:54 AMСоветую Вам хорошую пасеку, на которой заказываю большой ассортимент продуктов пчеловодства как для себя таки для своих друзей. Пчеловоды высылают всю продукцию пчеловодства на отлично, советы как употреблять по важным вопросам дают. Очень много нужных статей на сайте, Вот несколько из них: http://www.adtgamer.com.br/showthread.php?p=486221#post486221 http://www.jeepin.com/forum/member.php?u=175322 http://www.jeepin.com/forum/member.php?u=116760 http://www.ts-gaminggroup.com/showthread.php?181050-%D0%A0%D1%9F%D0%A0%C2%B5%D0%A1%D0%82%D0%A0%D1%96%D0%A0%C2%B0-%D0%A0%D1%9F%D0%A1%E2%80%A1%D0%A0%C2%B5%D0%A0%C2%BB%D0%A1%E2%80%B9&p=1090557#post1090557 http://www.adtgamer.com.br/showthread.php?p=488443#post488443 Одним словом они молодцы и я их советую. Вот их портал где я оформлял иммуностимулирующие продукты.

Советую Вам хорошую пасеку, на которой покупаю большой ассортимент продукции как для себя таки для своих родных. Пчеловоды делают всю пчелопродукцию на отменно, советы как принимать по важным вопросам дают. Очень много качественных статей на блоге, Вот несколько из них: http://adtgamer.com.br/showthread.php?p=488959#post488959 http://forum.modelka.com.ua/members/48192-Veronayry http://adtgamer.com.br/showthread.php?p=488994#post488994 http://adtgamer.com.br/showthread.php?p=488886#post488886 http://himeuta.org/member.php?1530339-Svetlanajvb Одним словом они молодцы и я их советую. Вот их портал где я оформлял продукцию.

19 Nov 2024 14:33 PMСоветую Вам хорошую пасеку, на которой покупаю большой ассортимент продукции как для себя таки для своих родных. Пчеловоды делают всю пчелопродукцию на отменно, советы как принимать по важным вопросам дают. Очень много качественных статей на блоге, Вот несколько из них: http://adtgamer.com.br/showthread.php?p=488959#post488959 http://forum.modelka.com.ua/members/48192-Veronayry http://adtgamer.com.br/showthread.php?p=488994#post488994 http://adtgamer.com.br/showthread.php?p=488886#post488886 http://himeuta.org/member.php?1530339-Svetlanajvb Одним словом они молодцы и я их советую. Вот их портал где я оформлял продукцию.

Каждый из нас любит почитать СМИ или посмотреть Youtube, что узнать что происходит в мире и Украине. Но очень важно чтоб источник новостей был честный и Вы не получали искаженную информацию. Я нашел очень хороший сайт и советую его Вам - ukr-life.com.ua Последнее время изучаю новости только здесь. Так же вот несколько из последних новостей, которые просто взрывает мозг: http://www.smokinstangs.com/member.php/276244-Igorjjw http://www.smokinstangs.com/member.php/276108-Igormcw http://forum.d-dub.com/member.php?836969-Igorfiu http://www.spearboard.com/member.php?u=803269 http://www.adtgamer.com.br/showthread.php?p=494047#post494047

19 Nov 2024 14:33 PMКаждый из нас любит почитать СМИ или посмотреть Youtube, что узнать что происходит в мире и Украине. Но очень важно чтоб источник новостей был честный и Вы не получали искаженную информацию. Я нашел очень хороший сайт и советую его Вам - ukr-life.com.ua Последнее время изучаю новости только здесь. Так же вот несколько из последних новостей, которые просто взрывает мозг: http://www.smokinstangs.com/member.php/276244-Igorjjw http://www.smokinstangs.com/member.php/276108-Igormcw http://forum.d-dub.com/member.php?836969-Igorfiu http://www.spearboard.com/member.php?u=803269 http://www.adtgamer.com.br/showthread.php?p=494047#post494047

Занимаюсь оздоровлением уже более 10 лет. И вот недавно прочитал информацию что продукты пчелы очень полезны и отлично повышают иммунитет. Перечитав много информации на сайте, я узнал много полезного для себя. А так же нашел большое количество народных рецептов на основе медопродуктов. Вот кстати несколько хороших статей: http://www.ts-gaminggroup.com/member.php?100474-Evadsc http://www.novoselovo.ru/user/Evavwd/ http://www.smokinstangs.com/member.php/284329-Evasrl http://www.smokinstangs.com/member.php/284763-Evabmy http://forums.panzergrenadiers.com/member.php?41136-Evaimq Думаю Вам будет полезно...

19 Nov 2024 20:53 PMЗанимаюсь оздоровлением уже более 10 лет. И вот недавно прочитал информацию что продукты пчелы очень полезны и отлично повышают иммунитет. Перечитав много информации на сайте, я узнал много полезного для себя. А так же нашел большое количество народных рецептов на основе медопродуктов. Вот кстати несколько хороших статей: http://www.ts-gaminggroup.com/member.php?100474-Evadsc http://www.novoselovo.ru/user/Evavwd/ http://www.smokinstangs.com/member.php/284329-Evasrl http://www.smokinstangs.com/member.php/284763-Evabmy http://forums.panzergrenadiers.com/member.php?41136-Evaimq Думаю Вам будет полезно...

Занимаюсь оздоровлением уже более 10 лет. И вот недавно услышал информацию что пчелопродукты очень нужны и отлично укрепляют иммунитет. Перечитав большое количество информации на сайте, я узнал много полезного для себя. А так же нашел множество народных рецептов на основе продуктов пчелы. Вот кстати несколько полезных статей: http://www.adtgamer.com.br/showthread.php?p=496961#post496961 http://himeuta.org/member.php?1537404-Evacpj http://forum.d-dub.com/member.php?848809-Evacwe http://www.dendymaster.ru/forum/showthread.php?p=40044#post40044 http://www.spearboard.com/member.php?u=814292 Думаю Вам будет полезно...

20 Nov 2024 09:24 AMЗанимаюсь оздоровлением уже более 10 лет. И вот недавно услышал информацию что пчелопродукты очень нужны и отлично укрепляют иммунитет. Перечитав большое количество информации на сайте, я узнал много полезного для себя. А так же нашел множество народных рецептов на основе продуктов пчелы. Вот кстати несколько полезных статей: http://www.adtgamer.com.br/showthread.php?p=496961#post496961 http://himeuta.org/member.php?1537404-Evacpj http://forum.d-dub.com/member.php?848809-Evacwe http://www.dendymaster.ru/forum/showthread.php?p=40044#post40044 http://www.spearboard.com/member.php?u=814292 Думаю Вам будет полезно...

Вы слышали что творится с Битком? Я был в шоке как он стал дороже за последнее время. И даже если будет спад я все равно буду докупать его и инвестировать. Но чтоб повысить свой уровень финансовой грамотности, решил подобрать портал, на котором смогу изучить информацию про все криптовалюты. Мне понравился сайт. На данном портале я смог найти статьи про каждую криптовалюту из ТОП 200. Получил полную информацию как майнить крипту. Вот одной из последних новостей хотел бы поделиться с Вами: Также нашел советы инвесторов как расти на падающем рынке и как пережидать коррекцию рынка. Читайте и становитесь богаче и умней!!! http://islamavenir.free.fr/member.php?897-Davidnir http://forums.panzergrenadiers.com/member.php?40945-Davidypy http://www.jeepin.com/forum/member.php?u=119331 http://www.adtgamer.com.br/showthread.php?p=488754#post488754 http://www.jeepin.com/forum/member.php?u=119668

20 Nov 2024 09:24 AMВы слышали что творится с Битком? Я был в шоке как он стал дороже за последнее время. И даже если будет спад я все равно буду докупать его и инвестировать. Но чтоб повысить свой уровень финансовой грамотности, решил подобрать портал, на котором смогу изучить информацию про все криптовалюты. Мне понравился сайт. На данном портале я смог найти статьи про каждую криптовалюту из ТОП 200. Получил полную информацию как майнить крипту. Вот одной из последних новостей хотел бы поделиться с Вами: Также нашел советы инвесторов как расти на падающем рынке и как пережидать коррекцию рынка. Читайте и становитесь богаче и умней!!! http://islamavenir.free.fr/member.php?897-Davidnir http://forums.panzergrenadiers.com/member.php?40945-Davidypy http://www.jeepin.com/forum/member.php?u=119331 http://www.adtgamer.com.br/showthread.php?p=488754#post488754 http://www.jeepin.com/forum/member.php?u=119668

Занимаюсь лечением уже более 10 лет. И вот недавно услышал информацию что продукты пчелы очень нужны и отлично укрепляют иммунитет. Перечитав массу информации на сайте, я узнал много полезного для себя. А так же нашел массу народных рецептов на основе медопродуктов. Вот кстати несколько полезных статей: http://www.forumdipace.org/profile.php?mode=viewprofile&u=370199 http://www.smokinstangs.com/member.php/366853-Evastd http://www.ra-journal.ru/board/member.php?261694-Evaxgk http://forum.ll2.ru/member.php?888057-Evatbs http://www.c-strike.fakaheda.eu/forum/viewthread.php?thread_id=67125 Думаю Вам будет полезно...

20 Nov 2024 14:48 PMЗанимаюсь лечением уже более 10 лет. И вот недавно услышал информацию что продукты пчелы очень нужны и отлично укрепляют иммунитет. Перечитав массу информации на сайте, я узнал много полезного для себя. А так же нашел массу народных рецептов на основе медопродуктов. Вот кстати несколько полезных статей: http://www.forumdipace.org/profile.php?mode=viewprofile&u=370199 http://www.smokinstangs.com/member.php/366853-Evastd http://www.ra-journal.ru/board/member.php?261694-Evaxgk http://forum.ll2.ru/member.php?888057-Evatbs http://www.c-strike.fakaheda.eu/forum/viewthread.php?thread_id=67125 Думаю Вам будет полезно...

Вы читали что делается с Битком? Я был в ужасе как он вырос за последнее время. И даже если будет упадок я все равно буду покупать его и инвестировать. Но чтоб поднять свой уровень финансовой грамотности, решил подобрать сайт, на котором смогу читать информацию про все криптовалюты. Мне понравился сайт. На данном портале я смог найти информацию про каждую криптовалюту из ТОП 200. Получил полную информацию как майнить криптовалюту. Вот одной из последних новостей хотел бы поделиться с Вами: Также нашел рекомендации инвесторов как зарабатывать на падающем рынке и как пережидать коррекцию рынка. Читайте и становитесь богаче и умней!!! http://www.glaschat.ru/glas-f/member.php?321891-Davidwej http://test.durdom.club/viewtopic.php?f=3&t=50169 http://www.ra-journal.ru/board/member.php?261260-Davidzyy http://adtgamer.com.br/showthread.php?p=489428#post489428 http://kick.gain.tw/viewthread.php?tid=4701875&extra=

20 Nov 2024 14:48 PMВы читали что делается с Битком? Я был в ужасе как он вырос за последнее время. И даже если будет упадок я все равно буду покупать его и инвестировать. Но чтоб поднять свой уровень финансовой грамотности, решил подобрать сайт, на котором смогу читать информацию про все криптовалюты. Мне понравился сайт. На данном портале я смог найти информацию про каждую криптовалюту из ТОП 200. Получил полную информацию как майнить криптовалюту. Вот одной из последних новостей хотел бы поделиться с Вами: Также нашел рекомендации инвесторов как зарабатывать на падающем рынке и как пережидать коррекцию рынка. Читайте и становитесь богаче и умней!!! http://www.glaschat.ru/glas-f/member.php?321891-Davidwej http://test.durdom.club/viewtopic.php?f=3&t=50169 http://www.ra-journal.ru/board/member.php?261260-Davidzyy http://adtgamer.com.br/showthread.php?p=489428#post489428 http://kick.gain.tw/viewthread.php?tid=4701875&extra=

Вы видели что делается с Биткоином? Я был в шоке как он возрос за последнее время. И даже если будет упадок я все равно буду докупать его и инвестировать. Но чтоб поднять свой уровень финансовой грамотности, решил найти портал, на котором смогу читать информацию про все криптовалюты. Мне понравился сайт. На данном сайте я смог найти информацию про каждую криптовалюту из ТОП 200. Получил нужную мне информацию как майнить крипту. Вот одной из свежих новостей хотел бы поделиться с Вами: Также нашел рекомендации инвесторов как инвестировать на падающем рынке и как пережидать упадок рынка. Читайте и становитесь богаче и умней!!! http://www.schalke04.cz/forum/viewthread.php?thread_id=135374 http://forum.ll2.ru/member.php?700990-Davidpzy http://www.glaschat.ru/glas-f/member.php?322308-Davidapc http://mail.spearboard.com/member.php?u=1273947 http://users.atw.hu/nlw/viewtopic.php?p=46063#46063

21 Nov 2024 10:27 AMВы видели что делается с Биткоином? Я был в шоке как он возрос за последнее время. И даже если будет упадок я все равно буду докупать его и инвестировать. Но чтоб поднять свой уровень финансовой грамотности, решил найти портал, на котором смогу читать информацию про все криптовалюты. Мне понравился сайт. На данном сайте я смог найти информацию про каждую криптовалюту из ТОП 200. Получил нужную мне информацию как майнить крипту. Вот одной из свежих новостей хотел бы поделиться с Вами: Также нашел рекомендации инвесторов как инвестировать на падающем рынке и как пережидать упадок рынка. Читайте и становитесь богаче и умней!!! http://www.schalke04.cz/forum/viewthread.php?thread_id=135374 http://forum.ll2.ru/member.php?700990-Davidpzy http://www.glaschat.ru/glas-f/member.php?322308-Davidapc http://mail.spearboard.com/member.php?u=1273947 http://users.atw.hu/nlw/viewtopic.php?p=46063#46063

Занимаюсь лечением уже более 10 лет. И вот недавно узнал информацию что пчелопродукты очень нужны и отлично повышают иммунитет. Перечитав большое количество информации на сайте, я узнал много полезного для себя. А так же нашел большое количество народных рецептов на основе медопродуктов. Вот кстати несколько хороших статей: http://rapbeatsforum.com/viewtopic.php?t=317222 http://www.smokinstangs.com/member.php/284075-Evaqmg http://www.adtgamer.com.br/showthread.php?p=491342#post491342 http://www.algazalischool.com/vb/showthread.php?144569-%D1%E2%EE%E9%F1%F2%E2%E0-%EF%E5%F0%E3%E8-%E8-%EF%F0%EE%F2%E8%E2%EE%EF%EE%EA%E0%E7%E0%ED%E8%FF&p=735885#post735885 http://himeuta.org/member.php?1537125-Evahnh Думаю Вам будет полезно...

21 Nov 2024 15:24 PMЗанимаюсь лечением уже более 10 лет. И вот недавно узнал информацию что пчелопродукты очень нужны и отлично повышают иммунитет. Перечитав большое количество информации на сайте, я узнал много полезного для себя. А так же нашел большое количество народных рецептов на основе медопродуктов. Вот кстати несколько хороших статей: http://rapbeatsforum.com/viewtopic.php?t=317222 http://www.smokinstangs.com/member.php/284075-Evaqmg http://www.adtgamer.com.br/showthread.php?p=491342#post491342 http://www.algazalischool.com/vb/showthread.php?144569-%D1%E2%EE%E9%F1%F2%E2%E0-%EF%E5%F0%E3%E8-%E8-%EF%F0%EE%F2%E8%E2%EE%EF%EE%EA%E0%E7%E0%ED%E8%FF&p=735885#post735885 http://himeuta.org/member.php?1537125-Evahnh Думаю Вам будет полезно...

Занимаюсь лечением уже более 10 лет. И вот недавно узнал информацию что продукты пчелы очень нужны и отлично укрепляют иммунитет. Перечитав большое количество информации на сайте, я узнал много полезного для себя. А так же нашел множество народных рецептов на основе медопродуктов. Вот кстати несколько хороших статей: http://www.glaschat.ru/glas-f/member.php?322634-Evaazp http://www.c-strike.fakaheda.eu/forum/viewthread.php?thread_id=67025 http://www.oople.com/forums/member.php?u=244241 http://www.ra-journal.ru/board/member.php?295630-Evaqsf http://indie-resource.com/forums/viewtopic.php?t=17860 Думаю Вам будет полезно...

21 Nov 2024 23:44 PMЗанимаюсь лечением уже более 10 лет. И вот недавно узнал информацию что продукты пчелы очень нужны и отлично укрепляют иммунитет. Перечитав большое количество информации на сайте, я узнал много полезного для себя. А так же нашел множество народных рецептов на основе медопродуктов. Вот кстати несколько хороших статей: http://www.glaschat.ru/glas-f/member.php?322634-Evaazp http://www.c-strike.fakaheda.eu/forum/viewthread.php?thread_id=67025 http://www.oople.com/forums/member.php?u=244241 http://www.ra-journal.ru/board/member.php?295630-Evaqsf http://indie-resource.com/forums/viewtopic.php?t=17860 Думаю Вам будет полезно...

Вы читали что делается с Битком? Я был в ужасе как он вырос за последнее время. И даже если будет спад я все равно буду докупать его и инвестировать. Но чтоб улучшить свой уровень финансовой грамотности, решил поискать сайт, на котором смогу изучить информацию про все криптовалюты. Мне понравился сайт. На данном портале я смог найти инфу про каждую криптовалюту из ТОП 200. Получил полезную информацию как майнить криптовалюту. Вот одной из последних новостей хотел бы поделиться с Вами: Также нашел советы инвесторов как зарабатывать на падающем рынке и как пережидать спад рынка. Читайте и становитесь богаче и умней!!! http://www.adtgamer.com.br/showthread.php?p=487434#post487434 http://www.smokinstangs.com/member.php/283378-Davidkpc http://forum.mozilla-russia.org/profile.php?id=129137 http://www.ts-gaminggroup.com/member.php?447913-Davidjyb http://www.adtgamer.com.br/showthread.php?p=490327#post490327

22 Nov 2024 11:06 AMВы читали что делается с Битком? Я был в ужасе как он вырос за последнее время. И даже если будет спад я все равно буду докупать его и инвестировать. Но чтоб улучшить свой уровень финансовой грамотности, решил поискать сайт, на котором смогу изучить информацию про все криптовалюты. Мне понравился сайт. На данном портале я смог найти инфу про каждую криптовалюту из ТОП 200. Получил полезную информацию как майнить криптовалюту. Вот одной из последних новостей хотел бы поделиться с Вами: Также нашел советы инвесторов как зарабатывать на падающем рынке и как пережидать спад рынка. Читайте и становитесь богаче и умней!!! http://www.adtgamer.com.br/showthread.php?p=487434#post487434 http://www.smokinstangs.com/member.php/283378-Davidkpc http://forum.mozilla-russia.org/profile.php?id=129137 http://www.ts-gaminggroup.com/member.php?447913-Davidjyb http://www.adtgamer.com.br/showthread.php?p=490327#post490327

Занимаюсь очищением уже более 10 лет. И вот недавно услышал информацию что пчелопродукты очень нужны и отлично укрепляют иммунитет. Перечитав массу информации на сайте, я узнал много полезного для себя. А так же нашел множество народных рецептов на основе продуктов пчелы. Вот кстати несколько полезных статей: http://forum.ll2.ru/member.php?703189-Evarbi http://www.ym7ka.com/forum/member.php?action=profile&uid=24730 http://www.glaschat.ru/glas-f/member.php?442553-Evaoea http://forum.politm.ro/viewtopic.php?f=17&t=9787 http://gear-monkey.com/forum/showthread.php?p=20979#post20979 Думаю Вам будет полезно...

22 Nov 2024 11:24 AMЗанимаюсь очищением уже более 10 лет. И вот недавно услышал информацию что пчелопродукты очень нужны и отлично укрепляют иммунитет. Перечитав массу информации на сайте, я узнал много полезного для себя. А так же нашел множество народных рецептов на основе продуктов пчелы. Вот кстати несколько полезных статей: http://forum.ll2.ru/member.php?703189-Evarbi http://www.ym7ka.com/forum/member.php?action=profile&uid=24730 http://www.glaschat.ru/glas-f/member.php?442553-Evaoea http://forum.politm.ro/viewtopic.php?f=17&t=9787 http://gear-monkey.com/forum/showthread.php?p=20979#post20979 Думаю Вам будет полезно...

Занимаюсь очищением уже более 10 лет. И вот недавно услышал информацию что пчелопродукты очень полезны и отлично укрепляют иммунитет. Перечитав большое количество информации на сайте, я узнал много полезного для себя. А так же нашел большое количество народных рецептов на основе пчелопродуктов. Вот кстати несколько полезных статей: http://www.oople.com/forums/member.php?u=564806 http://www.smokinstangs.com/member.php/284800-Evajed http://forum.fragoria.com/member.php?u=176942 http://www.ts-gaminggroup.com/member.php?542540-Evaitz http://www.smokinstangs.com/member.php/283804-Evaplq Думаю Вам будет полезно...

23 Nov 2024 12:15 PMЗанимаюсь очищением уже более 10 лет. И вот недавно услышал информацию что пчелопродукты очень полезны и отлично укрепляют иммунитет. Перечитав большое количество информации на сайте, я узнал много полезного для себя. А так же нашел большое количество народных рецептов на основе пчелопродуктов. Вот кстати несколько полезных статей: http://www.oople.com/forums/member.php?u=564806 http://www.smokinstangs.com/member.php/284800-Evajed http://forum.fragoria.com/member.php?u=176942 http://www.ts-gaminggroup.com/member.php?542540-Evaitz http://www.smokinstangs.com/member.php/283804-Evaplq Думаю Вам будет полезно...

Занимаюсь лечением уже более 10 лет. И вот недавно узнал информацию что продукты пчелы очень полезны и отлично повышают иммунитет. Перечитав массу информации на сайте, я узнал много полезного для себя. А так же нашел большое количество народных рецептов на основе пчелопродуктов. Вот кстати несколько хороших статей: http://www.forumdipace.org/profile.php?mode=viewprofile&u=415944 http://www.smokinstangs.com/member.php/284578-Evaxyu http://www.adtgamer.com.br/showthread.php?p=494391#post494391 http://www.victoriarabien.ugu.pl/forum/viewtopic.php?f=5&t=98011 http://www.forumdipace.org/profile.php?mode=viewprofile&u=154484 Думаю Вам будет полезно...

23 Nov 2024 20:15 PMЗанимаюсь лечением уже более 10 лет. И вот недавно узнал информацию что продукты пчелы очень полезны и отлично повышают иммунитет. Перечитав массу информации на сайте, я узнал много полезного для себя. А так же нашел большое количество народных рецептов на основе пчелопродуктов. Вот кстати несколько хороших статей: http://www.forumdipace.org/profile.php?mode=viewprofile&u=415944 http://www.smokinstangs.com/member.php/284578-Evaxyu http://www.adtgamer.com.br/showthread.php?p=494391#post494391 http://www.victoriarabien.ugu.pl/forum/viewtopic.php?f=5&t=98011 http://www.forumdipace.org/profile.php?mode=viewprofile&u=154484 Думаю Вам будет полезно...